“You Focus on Your Business & Let us Focus on Your Bookkeeping”

Launching your idea or already having one business. It takes passion and persistence to get where you are today!

If you are a startup or a small business owner and you need to maintain your financial books, you have reached the right click, “Account Ease”. Here we are to support you on the ‘Bookkeeping crash course’ at Account Ease.

A Successful Business relies on the best Bookkeeping Terms – here “Account Ease” will help you to maintain your books in a simpler way and driving your focus towards business success. AE will take you round the clock with What bookkeeping is, Why bookkeeping matters, and the basic steps for your business bookkeeping.

Introduction to Bookkeeping:

A process of tracking and recording day-to-day all company’s financial transactions. How business is spending money, how revenue is generated, and which tax deductions can be claimed. In a simpler way, it’s the process to maintain books physically or through Account Ease.

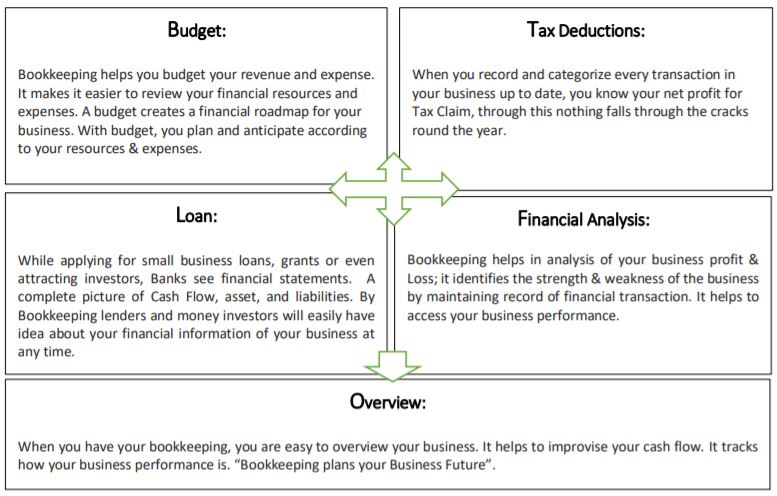

Why Bookkeeping Matters?

Bookkeeping is important to maintain your financial records, many businesses due to poor bookkeeping fail to implement this process as their integral part which leads to failure in their business.

Purpose of Bookkeeping:

How to START Bookkeeping?

- Step 01: Separate Business and Personal Expenses.

Make sure that your business and personal transactions are not intertwined.

WHY? Running a business with not having the difference between your personal & business finances, then there is a clear chance to be held liable for any debt incurred by your business.

This leads to stress while filing your taxes or doing bookkeeping. The collapse of both will lead to a legal problem and either way you end up losing money.

- Step 02: Single Entry vs Double Entry.

Here you have a two-way choice of the bookkeeping system. Single Entry & Double Entry System. Double entry is a bit complex but a well-specified system of accounting that completely tracks how your cash flow generates revenue & how the business is doing its expenditures. Every transaction is recorded twice, as Debit & Credit according to the nature of your transaction. For e.g. Buying a new laptop for your business costing £1000, the transaction will be recorded two-way Debit & Credit, Debit for Laptop considered as Asset & Credit for Paying Cash. In a Single entry, you record your transactions once as they happen, it’s less complicated. If your business is a sole proprietorship with no inventory and no employees, you use a single entry method & if your business setup is well established then you follow the double-entry method.

- Step 03: Accounting Method: Cash & Accrual.

Choosing between Cash & Accrual Method. Under Cash accounting, transactions are recorded when revenue is received. It is when you deposit the cheque into your bank account against your customer bill. Under the accrual basis, you record revenue when it’s earned from the customer even when money hasn’t exchanged hands. For small businesses or startups, you opt for the cash method.

However, if your business is well established earning more than five million in revenue and investments on a bigger scale you use the accrual method.

- Step 04: Choose the Right Tool.

Choose the process, will it be managed manually or through a bookkeeping system AE Accounting Solutions

- Step 05: Categorize Transactions.

Categorizing your transactions helps in the classification of your transactions and maintains the audit of your business. Not all transactions are equally tax-deductible, knowing what you’re spending on office supplies versus what you’re spending on meals.

- Step 06: Storing Documents

Storing your documents is the crucial step of showing your validity at the time of Tax. Storing documents for bookkeeping, today there’s a lot more to it. Nowadays, HMRC accepts digital records, as inks on receipts invoices never remain the same forever. The financial record shall be kept for three years. AE Bookkeeping Services is the best gateway to it.

- Step 07: Make it a habit

For the betterment of your future Business, keep Bookkeeping a habit – the smart financial insights into your business, every month of the year will result in saving a lot of your time and unrequited headache at the time of Tax season.

With Account Ease having a detailed insight on Bookkeeping, here you go to have the decision on doing the bookkeeping on your own or right away outsource the work to the professionals. Managing on your own will be Time-consuming, stressful due to single-handed and will take your focus from business away.

Ready to outsource your Bookkeeping

Outsource it to the professionals – “Account Ease” the Best Bookkeeping services in UK.

The solution to save your time, having more focused and growing business and being audited the right way, the finest way.

We have successfully completed bookkeeping for thousands of small businesses.

We will love to serve you at our best.

Happy Bookkeeping!!