Bookkeeping is an essential part of managing a business’s financial health, but it might seem confusing at first. Our guide explains the accounts jargon that might trip you up, and includes advice on how to get your bookkeeping right.

What is bookkeeping?

The process of bookkeeping involves recording all daily transactions that take place within a business in order to accurately show the income and expenditure.

Bookkeeping records must show how much money your business has received and spent as well as the amount it expects to receive in the future.

When you receive an invoice that you haven’t yet paid. It’s important to record the invoice in your books because you know that at some point you will have to pay. You can then plan your money needs and the dates for them (also known as Cash flow Management).

What is double-entry bookkeeping?

Double-entry accounting shows that every business transaction is an exchange. Double-entry bookkeeping allows you to record both sides of the exchange by recording the transaction twice.

A supplier invoice, for example, means that money has been spent, but it is offset by the return of goods or services.

How can double-entry bookkeeping help me to run my business efficiently?

Double-entry accounting is useful for recording your business transactions because it helps you to see where the money comes from and goes.

A sale, for example, means you don’t have the product or time period in your business. You can’t re-use these goods or services, even if you’ve not yet provided them.

The invoice shows that something left the company, but it is offset by the resource returning to the business. This is usually the money your customer pays for the sale. If you pay for staff or buy materials, the same applies. The money that leaves the business must be compared to the resources they provide.

How can I display transactions in double entry bookkeeping?

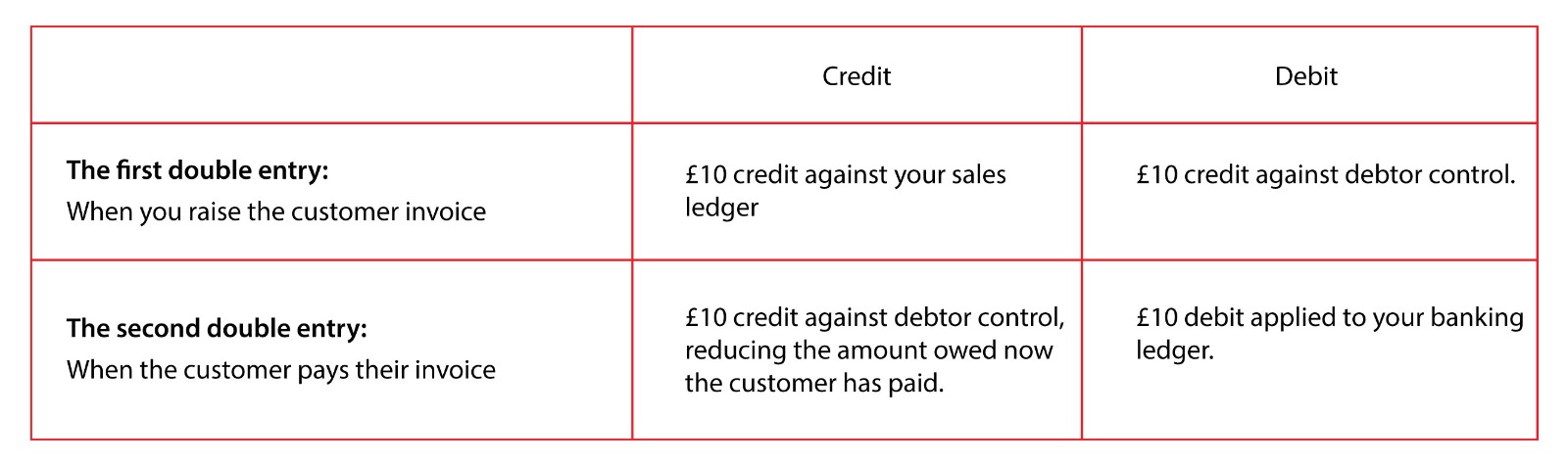

Invoices sent to customers are double entries. Receiving payment for an invoice is also a double entry.

The debit amount is credited to your sales when you issue an invoice. This is a double entry.

When the bill has been paid, you will need to make another double entry. Your ledger is debited because your bank balance increased. Credit is applied to the debtor control to reduce the amount due by the customer.

This example shows a business invoicing a client for £10 and showing it in their accounting with two double entries.

It’s easy to get mixed up when referring to credits and debits with the bank. When you put money in your bank account then the bank owes you this money, so they call it a credit. From your own accounting point of view though, an increase in your bank balance is a debit.

How do I know if my transactions match in double-entry bookkeeping?

Each of your financial transactions are recorded as a debit and a credit. On one side of the transaction is the debit, and on the other is the credit, so they cancel each other out and balance to zero. Running a trial balance report makes sure that these entries match.

Do I have to keep bookkeeping records for my business?

If you run a business then HMRC do expect you to maintain good bookkeeping records which show what’s happening in your business. This is true whether you’re a sole trader, a limited company, in a partnership, a freelancer, VAT registered, or any combination of these!

Your bookkeeping records form the basis of every tax return that you need to send, so it’s crucial that they’re accurate. Good bookkeeping helps you avoid uncomfortable conversations with HMRC auditors, (and any potential fines) but it’s useful for other reasons, too.

Keeping your financial records up-to-date helps you keep track of any money you owe and spot areas where you could save. You’ll find it much easier to manage your cash flow, too.

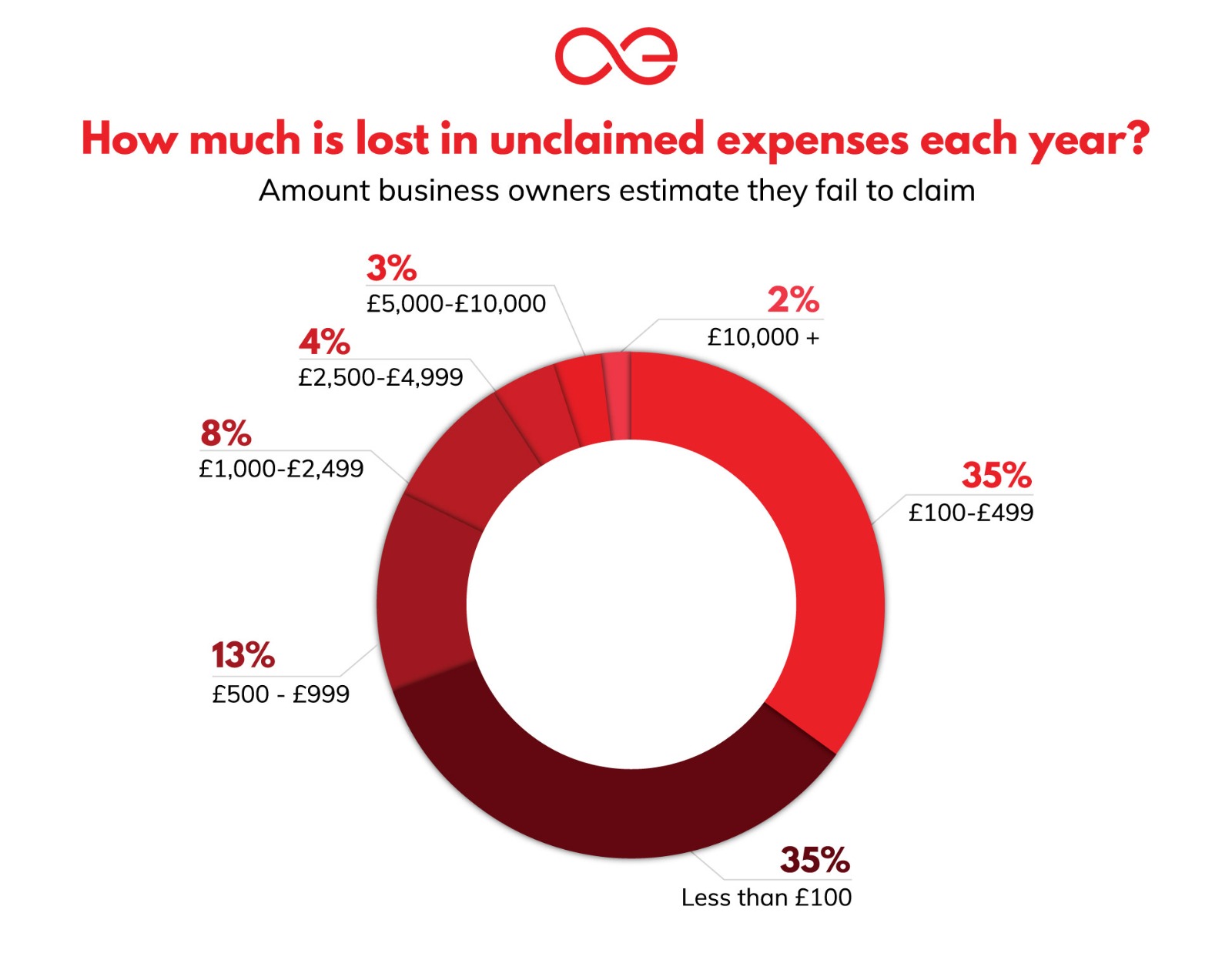

Recording all the money that you spend on your business means you’ll be able to claim tax relief by clawing back any allowable expenses. Huge numbers of business owners go without claiming tax relief on their business expenses every year – don’t be one of them!

What records should I keep for my bookkeeping?

You will find that your records show all transactions in your business. It includes all invoices you send or receive, banking transactions, expenses, and so on.

Your bookkeeping information will vary depending on how big your business is and how many transactions you have. Your records must include information such as the date, amount, purpose, customers, suppliers, and the name of the customer. You may also have to deal with international transactions. This will require you to think about the tax implications, and multiple currencies.

You can imagine that bookkeeping is a tedious job with all the data flying around. However, using bookkeeping software like Xero, QuickBooks, and Sage! can speed up this process.

Your bookkeeping records should include all supporting documents, as well as the transaction itself. You’ll also need to include the invoices themselves, so you will not only have a list but also the invoices.

Bookkeeping for sole-traders and limited companies

You should also consider how the structure of your business affects the documents that you maintain. There’s no difference in law between you and your business as a sole-trader, so the profits of your business are yours. This has tax implications. There is a guide that explains the bookkeeping process for sole trader bookkeeping and partnerships .

You are a separate entity from your business, and so must report both your income as well as the finances of your business.

What is the difference between bookkeeping and accounting?

Although the terms accounting and bookkeeping are often used interchangeably , they serve different purposes.

- Bookkeeping is the recording of financial transactions and cash flow management for a business.

- Accounting is the use of bookkeeping data to analyze and report how a business is performing. This helps make the right decisions at the right time.

These are both essential to the success of any business. They make it easy to identify what is working and where more attention should be paid.

Do I have to pay for my own bookkeeping services?

Bookkeeping for a small business or sole trader bookkeeping is usually fairly simple. You don’t have to hire a bookkeeper if you do it yourself.

How often should I perform my bookkeeping?

Bookkeeping is something that should be done on a regular basis. Don’t wait to get your books in order until you have to file your taxes!

Avoiding confusion and errors by keeping your bookkeeping up-to-date is important. Shop around for software that will keep you up to date if you don’t want to outsource or hire someone.

Bank feeds, for example, will link your records to your bank account and pull transactions into your bookkeeping, so you won’t have to manually enter them. This process is used by some software to reduce the time spent on bank reconciliation checks.

Bookkeeping Tips: Stay ahead of the game

Your bookkeeping is a vital part of the information you submit as part your tax return. Our bookkeeping team has some simple techniques that will help you avoid penalties and stress.

Decide on how you will keep your records

It’s important to have a system in place for tracking your cash flow and expenses. This can be done in a notebook, a spreadsheet or software. HMRC is rolling out Making Tax Digital, a new requirement to keep digital tax records.

MTD is already in place for some businesses, but you can choose to enroll voluntarily. Digital bookkeeping gives you an advantage!

Cloud-based accounting is the future of bookkeeping

Cloud-based accounting has become increasingly popular, and with good reason. Information stored in the cloud is accessible from anywhere. You can stay up to date even when you are away from your workspace.

Is cloud-based accounting software secure?

Yes, the quick answer is “yes”. The way businesses manage their accounts has changed as technology advances. As technology has evolved, software has also become more sophisticated.

These developments have also been influenced by financial legislation. Open Banking is a UK version of the European legislation PSD2 (Payment Services Directive).

According to the legislation, customers can grant their banks permission to share data. The bank must do this through a ‘language’ common to all platforms.

Once approved, these platforms can offer services such as cloud-based accounting software. For the software to be approved by banks, it must meet strict security requirements to protect your data.

Important dates to keep track of

You’ll want to set reminders throughout the year for important dates. You should also include important dates like loan repayments or payroll deadlines. You may have different deadlines based on the structure of your business. Check out our key dates for businesses.

Separate your business finances from personal finances

You may find it more convenient to have a bank account for your business, even though you are not legally required to do so unless you have a limited liability company.

Separating your personal finances from your business finances will help you to better manage your cash flow. You can also claim your expenses. It will be easier to keep track of your expenses and cash flow.

Keep your receipts, invoices and other documents.

Keep all the documents associated with your accounting records. HMRC requires it! You can either upload them directly into your software or store them in a folder. This will help you to claim your allowable expenditures – this graphic is eye-opening.

Complete and review your bookkeeping regularly

If you wait until you have time to deal with your bookkeeping, you’ll probably never actually do it. As a small business owner there are responsibilities coming out of your ears, but bookkeeping is just as important as the rest of them.

Keep your information up to date, and make sure you take time to review your financial reports (sometimes known as management accounts) regularly. Good bookkeeping software will generate financial reports automatically, helping you take more effective action in the business.

Take advice from a professional

If you aren’t a qualified bookkeeper, ask your accountant for some advice. They’ll also be able to help you set up a system which you can actually use and understand, if you’re doing it yourself.

Save for your tax bill

Whether you’re a sole trader or a limited company, always make sure you can pay your tax bill on time! Put money aside from every sale, so you can save for your tax bill as you go. Our article about UK tax explains this year’s rates and thresholds to help you prepare. And don’t forget about National Insurance!

If you’re a director you’ll need to think about what tax means for both you and for your company. Company directors normally need to submit a Self Assessment tax return for their own income, as well as a Company Tax Return to pay any Corporation Tax from the business. Good bookkeeping will help you prepare for both!

Call 0208 133 4599 to talk to one of the team about our online accounting and bookkeeping services, or get an instant online quote.