- Residential properties – Different rates apply based on the property price, with first-time buyer relief available in some regions.

- Additional properties – Higher tax rates usually apply to second homes and buy-to-let properties.

- Commercial properties – Separate rates and thresholds apply to non-residential property transactions.

Would you like a breakdown of the current tax rates for each region?

- Residential properties

- Non-residential properties

- Additional residential property purchases

- First-time buyers

- Leasehold properties

That’s a great point! Property taxes can significantly impact overall costs, so being informed is essential. Are you looking for details on rental income taxes in a specific UK region, or would you like a general overview?

Stamp Duty Land Tax (SDLT) – An Overview

Stamp Duty Land Tax (SDLT) is a tax on purchasing property or land in England and Northern Ireland. The amount to be paid is determined by the property’s value, nature, and whether it is a homebuyer, a first-time buyer, or a property investor.

Who is liable for SDLT?

You may be liable to pay SDLT when you buy:

- Residential buildings (including houses, apartments, and flats)

- Non-residential properties (such as commercial buildings and land)

- Additional residential properties (including second homes or buy-to-let investments)

- Leasehold houses (based on premium or transfer value)

SDLT Rates and Thresholds

The tax is computed in line with various price bands, with different charges for:

- Standard residential purchases

- First-time homebuyers (to whom relief is arguably applicable)

- Investors or those acquiring more properties

Understanding SDLT is also crucial in making informed financial decisions when purchasing property. Seeking advice or using a calculator for SDLT can provide an estimate of the tax liability and help to avoid unexpected expenses.

The SDLT amount is calculated based on the purchase price, and additional charges apply when buying second homes.

Non-Residential Stamp Duty Land Tax (SDLT)

Stamp Duty Land Tax (SDLT) is levied on buying or transfer of England and Northern Ireland’s non-residential and mixed-use properties. The properties that are not residential in nature are:

- Commercial buildings (such as offices, shopping centers, and warehouses)

- Agricultural land

- Land or property utilized for business

- Any property that is not occupied wholly for residential use

SDLT Rates for Non-Residential Properties

This tax is a progressive one, in that different parts of the purchase price are taxed at different rates.

As per the current SDLT rates:

- Up to £150,000 – 0% (SDLT is exempted)

- From £150,001 to £250,000 – 2%

- Over £250,000 – 5%

Leasehold Transactions

For leasehold buying of non-residential property, SDLT is payable on:

- The lease premium (based on purchase price)

- The net present value of rent during the period of lease (where more than £150,000, SDLT is payable at 1% of that in excess of £150,000)

Key Considerations

- SDLT is to be paid within 14 days of a transaction’s completion.

- Mixed-use properties (part residential, part commercial) are taxed at non-residential SDLT rates.

- Certain relief or exemption is applicable in respect of the nature of the transaction.

Understanding these rules is key to budgeting when buying commercial property. Seeking advice from a tax expert can assist in making accurate SDLT calculations and ensuring tax requirements are met.

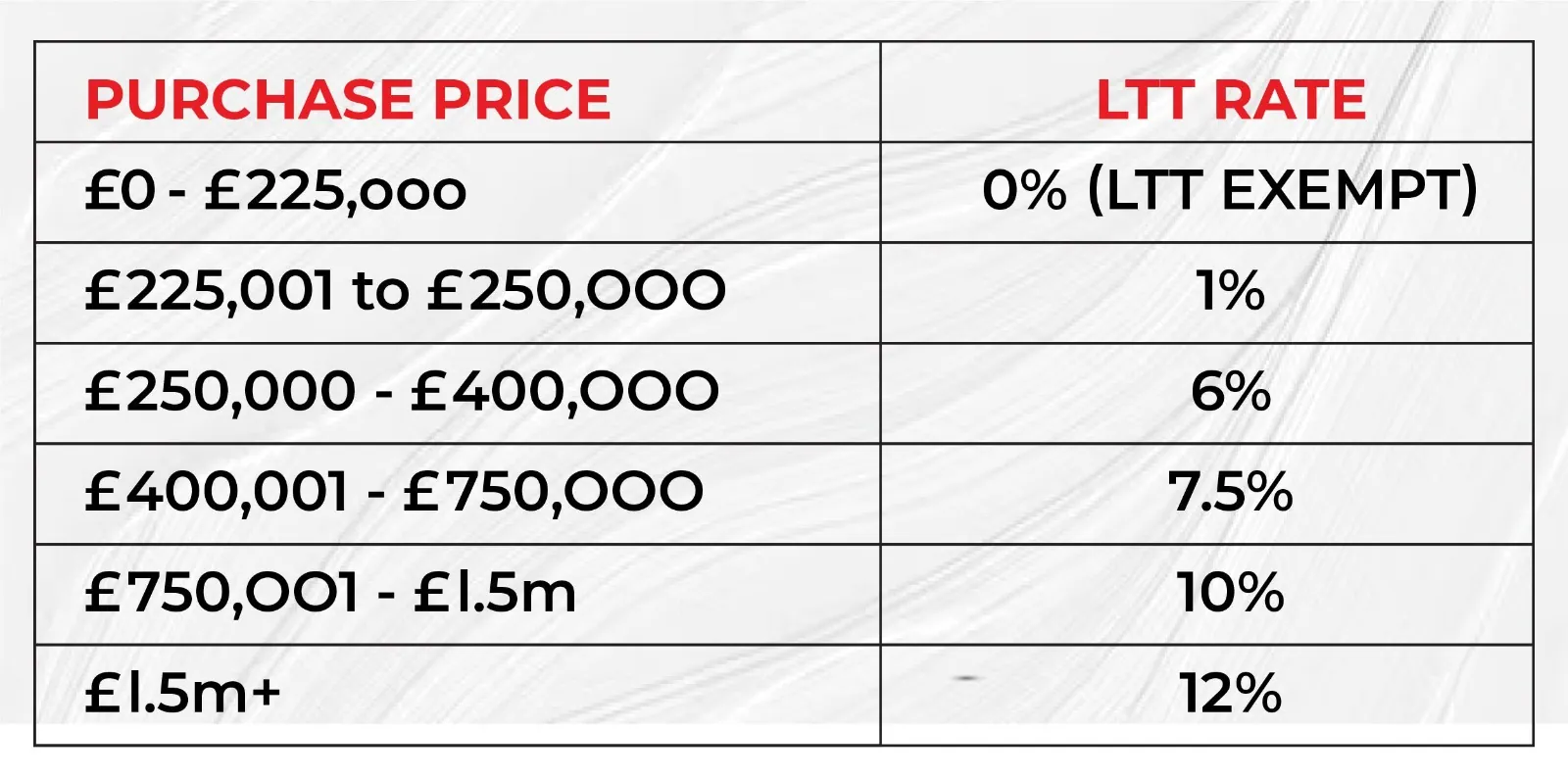

Land Transaction Tax (LTT) on Welsh Non-Residential Properties

In Wales, purchases of property are subject to Land Transaction Tax (LTT) in place of Stamp Duty Land Tax (SDLT). Both residential properties and mixed properties, such as:

- Commercial buildings (offices, shops, warehouses)

- Agricultural land

- Land for business or industrial use

- Mixed-use properties (part residential, part commercial)

LTT Rates for Non-Residential Properties

LTT is applied in a slab system, i.e., different parts of a property’s price are taxed at different rates:

LTT on Leasehold Transactions

For leasehold non-residential properties, LTT is payable on:

- Lease premium (up-front payment similar to purchase price)

- Net present value of lease payments during lease period, taxed accordingly:

- Up to £225,000 – 0%

- Above £225,000 – 1% of surplus

Key Considerations

- LTT is payable in 30 days after completion of the transaction.

- Mixed-use properties also pay non-residential LTT charges.

- Reliefs or exemptions in particular cases can be applicable.

Understanding LTT commitments is crucial to budgeting when purchasing or renting business property in Wales.

How Account Ease Can Help

Our expert team at Account Ease is here to assist you with all aspects of property tax. Get in touch with us today by calling 0208 133 4599or filling out our online contact form for professional guidance and support.